At this point in your life, you probably already know the basics of retirement planning:

start early, save as much as you can, take advantage of employer matches, and diversify your investments— all the usual tips. But if you’re a high-net-worth individual, you likely need to look beyond surface-level retirement advice. High-net-worth individuals face unique challenges and opportunities, and their retirement plans should factor those in.

What exactly does that look like? Read on to learn a few of our top high-net-worth retirement strategies, tips, and considerations.

Ready to Plan for a Worry-Free Retirement? Here are Our Top 5 High-Net-Worth Retirement Strategies:

1. Make sure that you are truly maxing out your retirement plans

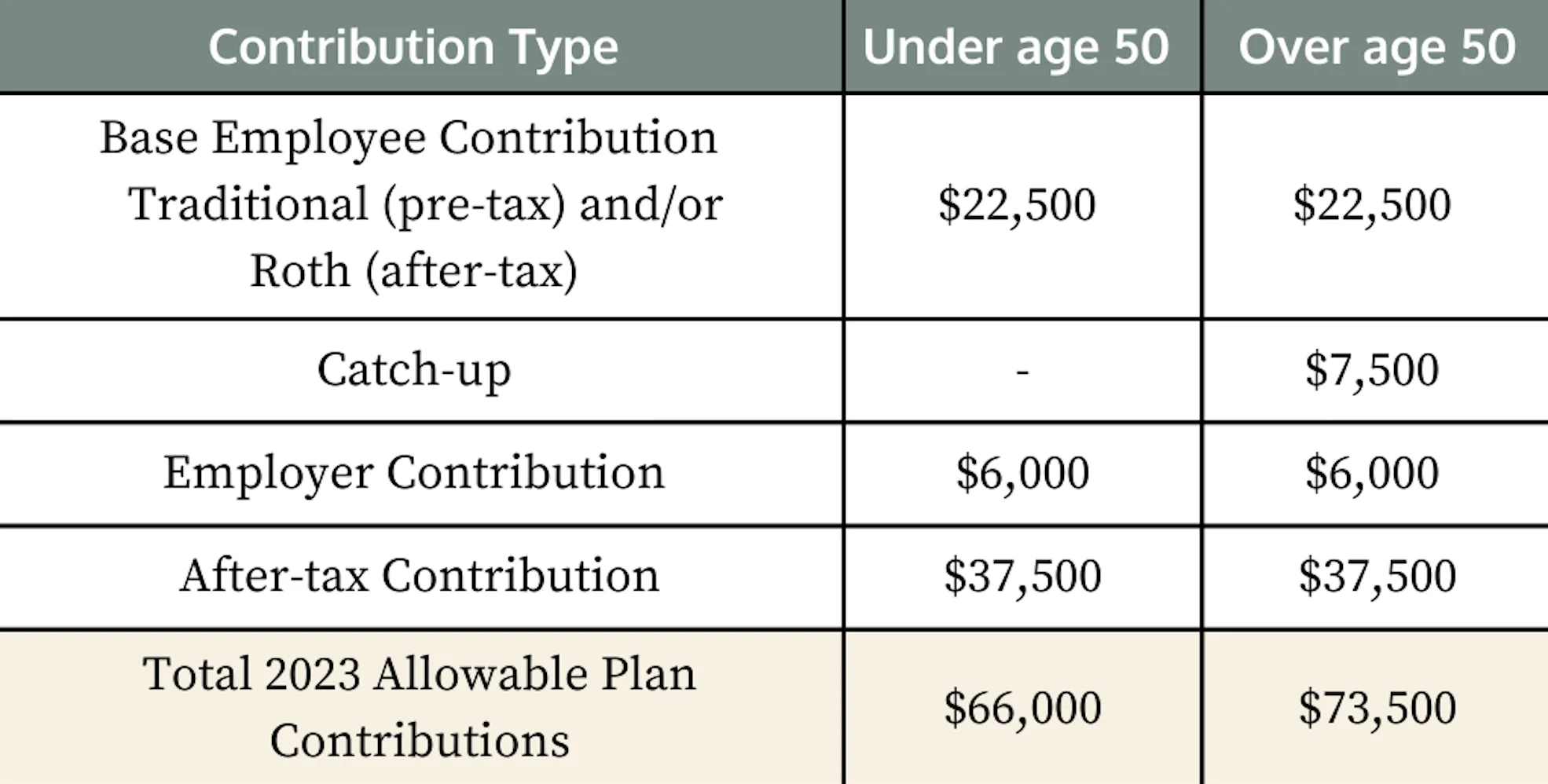

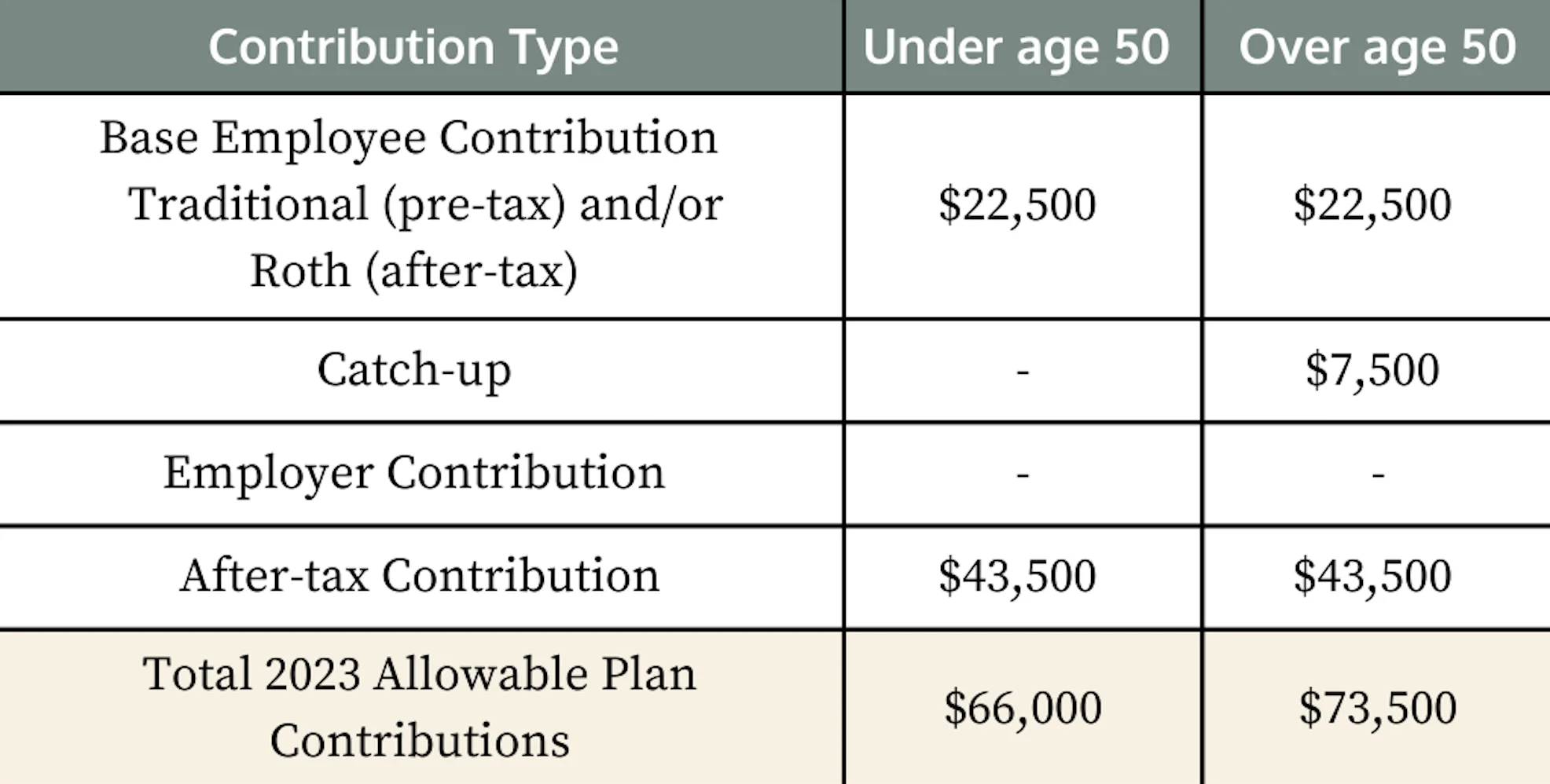

We all know that it is important to max out your retirement accounts from year-to-year. However, you may be able to contribute much more than you think! If your company offers an ‘After-Tax’ option, you may be able to contribute an additional $43,500 to your plan!

Even if you didn’t receive an employer contribution, you can still contribute up the through your after-tax dollars!

And if you are a business owner, if you added a Defined Benefit plan to your 401(k), you could potentially contribute more than $200,000 towards your retirement plan, providing a significant tax deduction and a tremendous boost to your retirement savings.

2. Divert Taxable Income Toward Roth Accounts

A lot of focus is placed on traditional (pre-tax) 401(k)s when it comes to retirement, and while there’s no doubt that they can be a valuable way to build wealth, they’re not the only account you should prioritize.

One of the great benefits of the traditional 401(k) is that it provides an upfront tax benefit. The amount you contribute to a traditional 401(k) reduces your taxable income by that amount, which helps reduce your tax liability in the year of the contribution. However, many do not realize that withdrawals are also subject to significant taxes–if you need $50,000, you may need to withdraw much more than that to account for taxes, eating away your retirement nest egg.

On the other hand, Roth 401(k)s and Roth IRAs allow for tax-free withdrawals because these accounts are funded with after-tax money. If you are able to build up your Roth, you are creating tax diversification because you have another bucket of funds to pull from during retirement, which provides a lot more flexibility in retirement planning for high-net-worth individuals!

- One strategy to consider is Roth conversions. This is a strategy where you move funds from your traditional IRA or 401(k) accounts into a Roth. You will pay tax on the amount you convert, but once it is in the Roth, it will grow tax-free and provide tax-free withdrawals.

- Another benefit of the Roth conversion is that your beneficiaries will inherit this asset tax-free! With the traditional/pre-tax funds, your non-spouse beneficiaries could be hit with a huge tax bill! If you have a $1 million IRA, they will have to pay the taxes on that $1 million as they take the distributions!

- Converting pre-tax money into a Roth can be especially handy in years when your income is low, like the period between when you retire and when you reach your Required Minimum Distribution (RMD) age. And with the passing of the recent SECURE Act 2.0, this could be as late as age 75.

3. Make a Difference in Your Community and Reduce Your Tax Bill

If you have accumulated a large retirement account, by the time your reach your RMD age, you could be looking at a large income tax bill. However, you can reduce this through a Qualified Charitable Distribution (QCD), which allows you to gift up to $100,000 of your RMD directly to a charity. So if your RMD was $150,000, you will only have to pay taxes on $50,000 if you donate $100,000 to your favorite non-profits. You get to reduce your taxes while the organizations you care about get much-needed funds, a win-win!

4. Be Ready for Any Outcome: Plan for Various Scenarios

No matter your level of wealth, it is important to know how much you are spending and how those expenses will change in retirement. As you approach retirement, take a look at your expenses and factor in any additional retirement spending you anticipate. You may want to travel around the world, spend more on hobbies or you may want to enter a senior community to take care of your long-term care needs.

You’ll want to contemplate the unexpected so you are prepared when life takes the inevitable twists and turns. Retirement plans should consider different scenarios like:

- Illness and accidents

- Early retirement

- Job loss

- Death of a partner

- Market declines

In the years approaching your retirement, considering these scenarios becomes all the more important — planning today will help you prepare for what’s soon to come.

5. Regularly Revisit Your Plan

Don’t think of your retirement plan as a fixed playbook. Over the years, your life will change, and your plan should be updated to reflect those changes. In general, it’s a good idea to revisit your retirement plan with your financial advisor at least once a year. As you approach retirement, you may want to increase that to two or three times per year. Going from paychecks to portfolio income is a big change, and you’ll want to feel confident about the transition ahead.

It’s also imperative that you revisit your retirement plan after major life changes, such as deaths or births in your family, marriage, or divorce. In those cases, reviewing your beneficiaries is particularly important, as you may need to remove or add someone. Keeping your beneficiaries updated is the best way to ensure that your assets go to the right people in the event of your death.

Plan Your High-Net-Worth Retirement With Confidence

With so many moving parts involved in high-net-worth retirement strategies, working with a financial advisor like one of our team members at Team Hewins can be the best way to make sense of them and make the most of them. Beyond creating a sound retirement plan, we can help you stay on top of any changes, in your life or the market. And most importantly, knowing that you’re as prepared as you can be for whatever life may have in store brings peace of mind.

Your retirement future can be as fulfilling as you wish with careful planning. To discuss your current finances, start building your retirement plan, or learn more about what we offer, reach out today and set up your complimentary 15-minute introductory call.

Team Hewins, LLC (“Team Hewins”) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training, and no inference to the contrary should be made. We provide this information with the understanding that we are not engaged in rendering legal, accounting, or tax services. We recommend that all investors seek out the services of competent professionals in any of the aforementioned areas. Certain information provided herein is based on third-party sources, which information, although believed to be accurate, has not been independently verified by Team Hewins. Team Hewins assumes no liability for errors and omissions in the information contained herein. Certain information contained herein constitutes forward-looking statements. Team Hewins does not guarantee the achievement of long-term goals in the portfolio review process. Past performance is no guarantee of future results, and a diversified portfolio does not guarantee a positive outcome. Nothing contained herein may be relied upon as a guarantee, promise, assurance, or a representation as to the future.