Time to Ride!

As you probably heard, Nvidia has had quite a run this year, as AI has suddenly become the Big Thing. Nvidia recently closed with a market cap over $1 trillion, and now there are five1:

1. Apple

2. Microsoft

3. Alphabet (Google)

4. Amazon

5. Nvidia

There are two more “big tech” companies approaching the $1 trillion dollar mark:

6. Tesla

7. Meta Platforms (Facebook)

We are once again seeing the big tech names dominating returns, after a brief respite last year when they tumbled sharply. In fact, most of the return of the S&P 500 this year is from these stocks alone.

We need a new term for these stocks – the Magnificent Seven!

FAANG (Facebook, Amazon, Apple, Netflix, and Google) was a term coined by Jim Cramer 10 years ago, although he added the second “A” for Apple in 2017. Think about that for a moment – in 2013 he didn’t even include Apple! He also left out Microsoft, now #2 on the list.2

Netflix was in FAANG because they needed an “N.” It ranks 34th among US companies, with a market cap below $200 billion. Pretty good, but hardly magnificent. We need something new, and the term “Magnificent Seven” seems to fit the bill perfectly.

The Seven Samurai – the original Magnificent Seven

Actually, the Magnificent Seven was a western remake of a Japanese classic, The Seven Samurai, which happens to be my favorite movie of all time. That scruffy, scowling character up front is one of my favorite actors, the late Toshiro Mifune. I just watched it again a few weeks ago, which is why the term Magnificent Seven jumped out at me when I heard it used on CNBC one recent morning.

These were both great movies, and these appear to be great companies, making history with innovations and spectacular growth. Quite an amazing time we live in. That being said, they have become very expensive relative to the rest of the equity markets here and abroad, and as we saw last year, they can fall fast and far. That’s why we stay diversified.

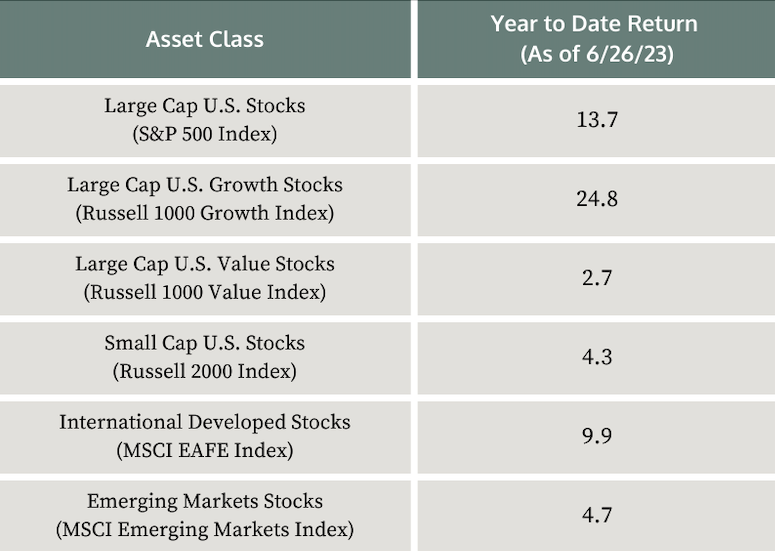

Tough Year for Value and Small Stocks

Source: Morningstar Direct, Data as of 6/26/23

As I mentioned above, last year was very tough for the big tech stocks, but this year so far they are back in force, accounting for most of the return in US equities. As you can see in the table above, large value and small stocks are up much less than the Russell 1000 (large cap) growth index, which has advanced almost 25%.

Happily, we are seeing good returns from international developed and emerging markets stocks, which have lagged in recent years. As we have mentioned in previous letters, these stocks appear cheap in terms of price earnings and price to book ratios, compared to US large growth stocks. We believe maintaining our commitment to these stocks helps control the risk of major downturns and keeps us in position to benefit when these stocks produce good returns.

These were both great movies… that’s why we stay diversified. So, time to go to the movies?

1. “Largest American Companies by Market Capitalization.” Companies Market Cap, companiesmarketcap.com/usa/largest-companies-in-the-usa-by-market-cap. Accessed 27 June 2023.

2. Mitra, Mallika. “Forget FAANG, Meet the ‘Magnificent Seven’ Stocks Surging in 2023.” Nasdaq, www.nasdaq.com/articles/forget-faang-meet-the-magnificent-seven-stocks-surging-in-2023. Accessed 27 June 2023.

3. Source: Morningstar Direct, Data as of 6/26/23

Team Hewins, LLC (“Team Hewins”) is an SEC registered investment adviser; however, such registration does not imply a certain level of skill or training, and no inference to the contrary should be made. We provide this information with the understanding that we are not engaged in rendering legal, accounting, or tax services. We recommend that all investors seek out the services of competent professionals in any of the aforementioned areas.

The volatilities of any comparative indices included in this presentation may be materially different from the individual performance attained by a specific client in a Team Hewins strategy. In addition, client holdings may differ significantly from the securities that comprise the indices. The indices have not been selected to represent an appropriate benchmark to compare an investor’s performance, but rather are disclosed to allow for comparison to the performances of certain well-known and widely recognized indices. The indices are unmanaged, include reinvestment of dividends, capital gain distributions or other earnings and do not reflect any fees or expenses. Indices cannot be invested in directly. Set forth below are descriptions of the indices included in the presentation.

Past performance is not an indication of future returns. Comments provided herein reflects Team Hewins’ views as of the date of this write up and are provided for informational purposes only. Such views are subject to change at any point without notice. Some of the information was obtained from third party sources believed to be reliable but the information is not guaranteed. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. Due to various risks and uncertainties no reliance should be placed on any such statements or forecasts when making any investment decision. Nothing presented herein is or intended to be investment advice or a recommendation to buy or sell any securities and no investment decision should be made based solely on the information provided. Team Hewins is not responsible for the consequences of any decisions or actions taken as a result of information provided in this writeup and does not warrant or guarantee the accuracy or completeness of the information. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses.

Source: © [2023] Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising.

Index Descriptions

- S&P 500 Index (Large Cap U.S. Stocks): measures the performance of large capitalization U.S. Stocks. It is a market-value-weighted index of 500 stocks that are traded on the NYSE, NYSE MKT, and NASDAQ. The weightings make each company’s influence on the Index performance directly proportional to that company’s market value.

- Russell 1000 Growth Index (Large Cap U.S. Growth Stocks): measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

- Russell 1000 Value Index (Large Cap U.S. Value Stocks): measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

- Russell 2000 Index (Small Cap U.S. Stocks): An unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index, representing approximately 10% of the total market capitalization of that index and includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. Russell Investment Group owns the Russell Index data, including all applicable trademarks and copyrights.

- MSCI EAFE Index (International Developed Stocks): The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI EAFE Index consists of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

- MSCI Emerging Markets Index (Emerging Markets Stocks): is a Morgan Stanley Capital International Index that is designed to measure the performance of equity markets in 25 emerging countries around the world.