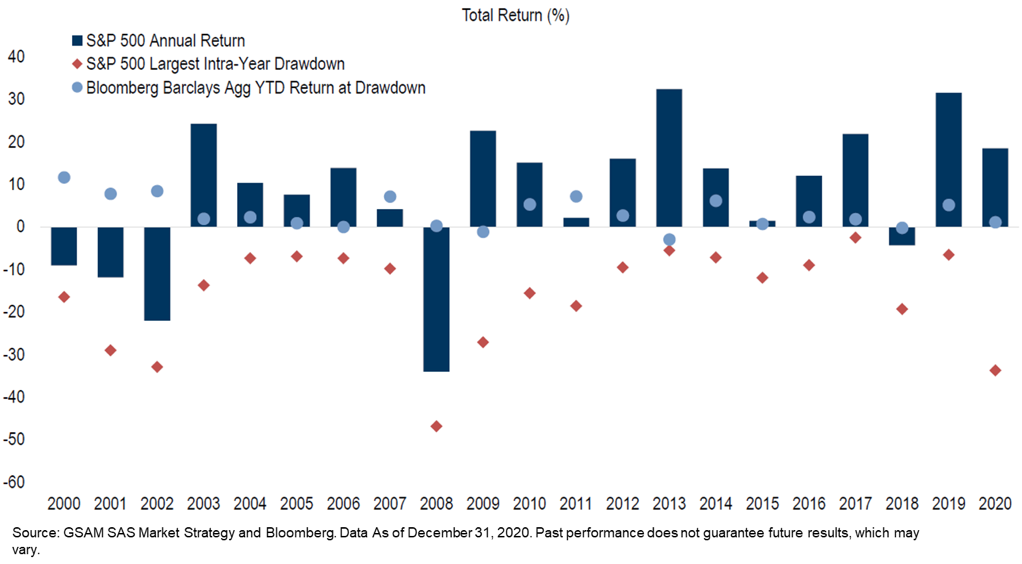

We’re asked about rising interest rates a lot, and in a blog post last month Roger Hewins addressed the stabilizing function of a bond allocation in a diversified portfolio. This chart looks at it in another interesting way:

The red diamonds indicate the largest drawdown (drop from peak to trough) for the S&P 500 during each of the past 20 years. You can see the big decline in 2008 during the global financial crisis and the most recent dive in the first quarter of 2020 as the market reacted to the pandemic, dropping over 30%.

The blue dots indicate year-to-date returns for bonds at the time of the stock drawdown. The first thing you notice is how narrow the range of bond returns is. During the biggest stock drawdowns in 2020 and 2008, bonds were essentially flat. The biggest decline for bonds was about 2% in 2013 (the “Taper Tantrum” Roger referenced). The distance between the dots and the diamonds from year to year is a powerful visualization of bonds’ important role.

One other interesting note—we know that last year produced the fastest bear market and recovery in stock market history. The other measure on this chart, the blue bar, represents the S&P 500’s return for the full year. So the distance between the top of the bar and the red diamond illustrates stock market volatility during the year, from the trough at the drawdown, to the end of the year.

That distance in 2020 was the biggest of the past 20 years—rivaled only by 2009, when the market also plunged in the first quarter but ended the year up 26.3%[i]. A lesson on staying the course as well.

[i] Source: Morningstar Direct. Data as of 12/31/2009

Team Hewins, LLC (“Team Hewins”) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. The information contained within this letter is for informational purposes only and should not be considered investment advice or a recommendation to buy or sell any types of securities. Past performance is not a guarantee of future returns. It should not be assumed that diversification protects a portfolio from loss or that the diversification in a portfolio will produce profitable results. The opinions stated herein are as of the date of this letter and are subject to change. The information contained within this letter is compiled from sources Team Hewins believes to be reliable, but we cannot guarantee accuracy. We provide this information with the understanding that we are not engaged in rendering legal, accounting, or tax services. We recommend that all investors seek out the services of competent professionals in any of the aforementioned areas.