Year-End 2020

After a year like this, I don’t know what to say. Belaboring the obvious seems pointless, and yet it seems incumbent on me to try to convey something meaningful. We can’t just let such an eventful year pass by unremarked.

What just happened here?!

Well, we were walking down the road (trying to loosen our load[i]) in an election year, minding our own business and preparing for God knows what kind of political fireworks, when something deadly crept up on us. Early in the year, we started hearing about an infectious disease in part of China, but at first, it was not seen as very serious.

After what looks in hindsight like a protracted period of being oblivious to the threat, followed by pointless political arguments and finger-pointing about it, we seemed to suddenly realize we had a rapidly spreading disease in our midst. You know the rest, at least through the end of 2020. And we are not done yet.

What about the Equity Markets?

One of the big puzzles of the year has been the sharp and very rapid recovery of equity markets, despite our continuing struggle with this awful disease. After plunging in February and March in response to the disease and the lockdowns, equities turned on a dime and rose just as fast, even before the end of March.[ii] By the end of the third quarter, overall equities were near breakeven.[iii]

One reason for this, as we have discussed almost ad nauseum, was the strength of the “Big Tech” stocks, which actually thrived during the lockdowns. Through the end of the third quarter, these were way ahead of small, value, international, and emerging markets stocks. Almost all the equity returns were coming from Big Tech.

A second reason, one we should always remember, is that capital markets live in the future, not the present. When you buy equities, you are buying a stream of future earnings; yesterday’s gone, it is what happens in the next x number of years that matters. Vaccines were coming, really fast, and the markets saw past the current suffering to an economy opened back up and running at full speed next year. Suddenly stocks looked cheap.

The Vaccine Rally

On the morning of November 9, Pfizer announced their vaccine had great results in a large clinical trial.[iv] What the markets had been expecting was now confirmed. The month of November turned out to be the best month for equities in a long time[v]–but not just for Big Tech anymore.

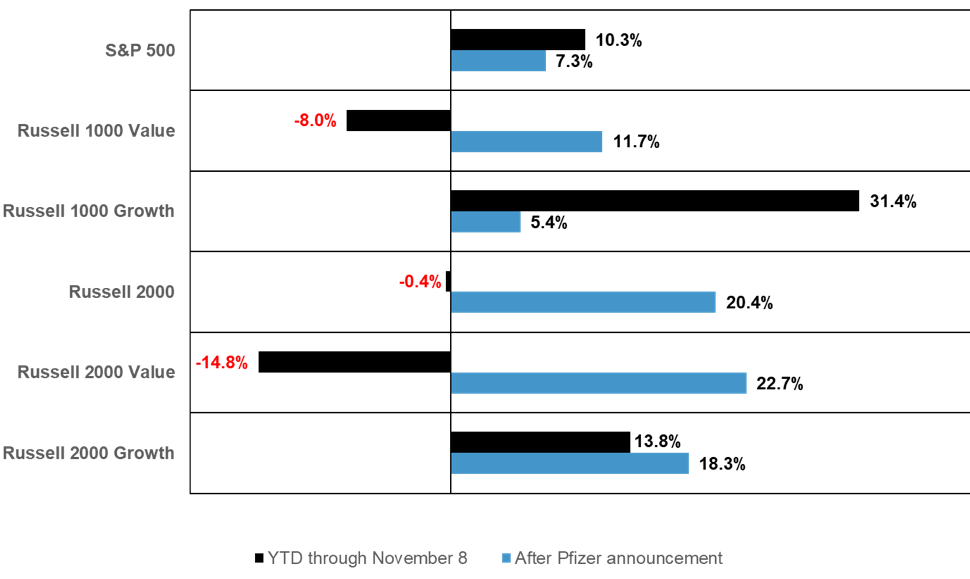

As you can see in the chart below, once we had confirmation that a vaccine was coming and we could expect the real economy back soon, the rest of the equity market took off. Value and small stocks outperformed by a lot. The Russell 2000 Small Cap Index, slightly negative for the year through November 8, rose a little more than 20% from that moment to year-end! It was up more than 31% for the full fourth quarter, the early gain perhaps anticipating positive vaccine news.[vi] International and emerging markets stocks did well too (see below).

Key Takeaway from this Market Experience

Earlier in the year, as we looked at a long period of Big Tech outperformance, driving the S&P 500 to outperform, questions were raised about investing in the other things– value and small stocks, but also international and emerging markets. That is natural when markets move to such extremes, as they do from time to time. But an investor who switched out of those things in Q3 would have missed a very sharp rally, as large cap was the worst, instead of the best, for a change:

Once again, discipline in the face of market events and difficulties paid off for investors who maintained their commitment to a diversified portfolio and resisted the lure of the shiny things with recent strong performance. These things come and go in unpredictable cycles, as we all know by now. It wasn’t “different this time” after all.

Happy New Year!

As this year finally comes to a close, and as we hope and pray for a better year starting real soon, we want to wish you all a very happy and safe new year! All our best to you and your families.

Sincerely,

Roger Hewins and the Crew

[i] Apologies to Jackson Browne and the Eagles, re: Take it Easy

[ii] Belvedere, M., 2020. The March Low May Have Been The Market Bottom, Says CEO Of The World’S Largest Money Manager. [online] CNBC. Available at: https://www.cnbc.com/2020/04/16/larry-fink-coronavirus-low-last-month-may-have-been-the-market-bottom.html [Accessed 31 December 2020].

[iii] Source: Morningstar Direct, data as of 9/30/2020

[iv] “Pfizer And Biontech Announce Vaccine Candidate Against COVID-19 Achieved Success In First Interim Analysis From Phase 3 Study | Pfizer”. Pfizer.Com, 2021 https://www.pfizer.com/news/press-release/press-release-detail/pfizer-and-biontech-announce-vaccine-candidate-against [Accessed 4 Jan 2021]

[v] Wallace, J. and Otani, A., 2020. Dow Falls But Holds On For Best Month In Over Three Decades. [online] WSJ. Available at: https://www.wsj.com/articles/global-stock-markets-dow-update-11-30-2020-11606732360 [Accessed 31 December 2020].

[vi] Source: Morningstar Direct, data as of 12/31/2020

Team Hewins, LLC (“Team Hewins”) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. The information contained within this letter is for informational purposes only and should not be considered investment advice or a recommendation to buy or sell any types of securities. Past performance is not a guarantee of future returns. It should not be assumed that diversification protects a portfolio from loss or that the diversification in a portfolio will produce profitable results. The opinions stated herein are as of the date of this letter and are subject to change. The information contained within this letter is compiled from sources Team Hewins believes to be reliable, but we cannot guarantee accuracy. We provide this information with the understanding that we are not engaged in rendering legal, accounting, or tax services. We recommend that all investors seek out the services of competent professionals in any of the aforementioned areas.

The volatilities of any comparative indices included in this presentation may be materially different from the individual performance attained by a specific client in a Team Hewins strategy. In addition, client holdings may differ significantly from the securities that comprise the indices. The indices have not been selected to represent an appropriate benchmark to compare an investor’s performance, but rather are disclosed to allow for comparison to the performances of certain well-known and widely recognized indices. The indices are unmanaged, include reinvestment of dividends, capital gain distributions or other earnings and do not reflect any fees or expenses. Indices cannot be invested in directly.